Home Equity Loans vs. Equity Loans: Recognizing the Distinctions

Home Equity Loans vs. Equity Loans: Recognizing the Distinctions

Blog Article

Exploring the Benefits of an Equity Lending for Your Monetary Goals

Among the range of financial devices readily available, equity fundings stand out for their prospective benefits in assisting people to reach their economic goals. The advantages that equity finances supply, varying from flexibility in fund usage to prospective tax benefits, offer an engaging case for factor to consider.

Adaptability in Fund Usage

Versatility in making use of funds is an essential advantage associated with equity finances, providing debtors with functional options for handling their funds properly. Equity financings permit individuals to access a line of credit score based on the equity they have actually built up in their homes.

Additionally, the adaptability in fund usage extends to the quantity borrowed, as consumers can typically access a large sum of cash depending on the equity they have in their home. This can be especially helpful for people seeking to fund considerable costs or jobs without turning to high-interest options. By leveraging the equity in their homes, customers can access the funds they need while gaining from possibly lower passion prices compared to various other kinds of loaning.

Potentially Lower Rate Of Interest

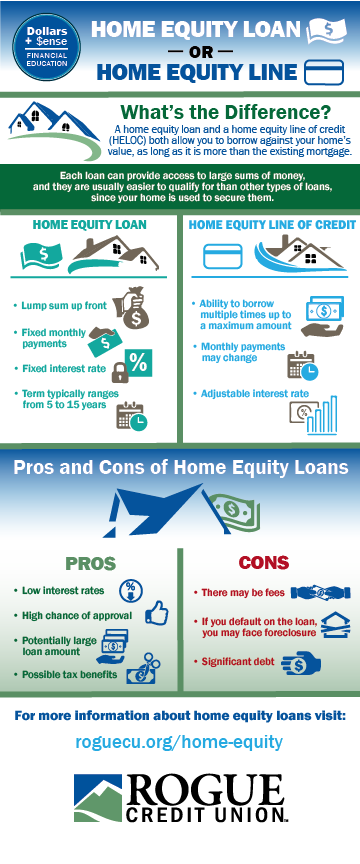

When thinking about equity car loans, one might locate that they use the possibility for lower rates of interest contrasted to alternative loaning alternatives, making them an eye-catching monetary choice for lots of individuals. This advantage comes from the fact that equity loans are protected by the debtor's home equity, which decreases the danger for loan providers. Because of this lowered degree of threat, lending institutions are frequently ready to offer reduced rate of interest on equity lendings than on unprotected lendings, such as individual fundings or charge card.

Reduced rates of interest can cause considerable price financial savings over the life of the funding. By securing a reduced interest price via an equity finance, customers can potentially reduce their overall interest expenditures and lower their monthly repayments. This can free up funds for other monetary goals or expenditures, inevitably enhancing the customer's financial placement in the lengthy run.

Accessibility to Larger Loan Amounts

Provided the possibility for reduced rate of interest with equity fundings due to their secured nature, debtors might also take advantage of accessibility to larger funding quantities based upon their available home equity. This access to larger funding amounts can be beneficial for people wanting to money substantial economic objectives or jobs (Equity Loans). Whether it's for home improvements, financial obligation loan consolidation, education and learning costs, or other significant investments, the ability to borrow more money through an equity funding gives customers Look At This with the economic flexibility needed to achieve their goals

Prospective Tax Advantages

Protecting an equity finance may use potential tax obligation benefits for customers looking for to optimize their financial advantages. In numerous situations, the rate of interest on an equity loan can be tax-deductible, comparable to home loan rate of interest, under certain problems.

Additionally, using an equity financing for home renovations might also have tax benefits. By utilizing the funds to remodel or improve a second or main home, homeowners might boost the residential property's worth. This can be advantageous when it comes time to offer the residential property, possibly minimizing resources gains tax obligations and even getting approved for certain exemption thresholds.

It is vital for borrowers to speak with a tax expert to totally comprehend the certain tax implications and benefits associated to equity loans in their specific scenarios. Alpine Credits Canada.

Faster Authorization Process

Final Thought

In summary, an equity financing uses versatility in fund usage, possibly lower rate of interest, access to bigger funding quantities, possible tax benefits, and a quicker authorization process. These benefits make equity fundings a practical alternative for people seeking to achieve their economic objectives (Alpine Credits). It is vital to meticulously consider the terms of an equity car loan prior to choosing to guarantee it aligns with your details monetary demands and goals

Given the possibility for reduced rate of interest prices with equity car loans due to their protected nature, consumers may additionally profit from accessibility to larger financing quantities based on their offered home equity (Equity Loans). In contrast, equity finances, leveraging the equity in your home, can use a quicker authorization process considering that the equity offers as collateral, reducing the threat for lenders. By picking an equity loan, debtors can expedite the funding authorization process and accessibility the funds they need immediately, offering an important financial service throughout times of urgency

Report this page